- Exercises p. 226, #4, 5

Begin with Exercise #3, p. 226:

- R2: a measure of fit

- See figure 4.5, p. 158

- R2 represents the amount of variation explained by the model against a constant model (using the mean: y=ybar). Recall this model from last time in several plots (the shotgun blast, the horizontal line).

- "Some books call R2 the coefficient of determination" (p. 159)

- Hint for Exercise #2, p. 226 (based on "trick" from last time)

- Finding R2 in the non-linear case

- same as R2 in the linear case!

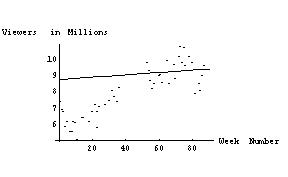

- Example - the X-files (using results from Mathematica)

- Typical use of regression: predict year two's results from year one's results

- Discussion of the "failures" of the process

- Using the model of the first season with the data of the second season results in a higher R2! Linear regression minimizes the Residual Sum of Squares, rather than maximizing R2.

- Season two would have done a woeful job of predicting year

one:

- Curvilinear models

- Catalog of functions - standard classes:

- ladder of powers

- exponential and log

- trigonometric (periodic) functions

- Intrinsically linear models - parameters are linear

- Linearizable models - parameters enter in a non-linear way, but data may be transformed to yield linear procedure

- Catalog of functions - standard classes:

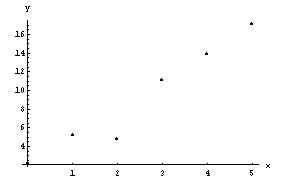

- Example: Cost of advertising. Comparison of various models:

- linear model

- log-linear (i.e. exponential linearizable model)

- log-log model (i.e. power linearizable model)

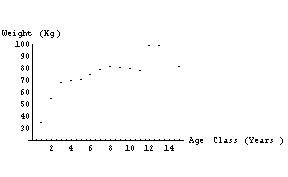

- If ever there were a data set crying out to be modeled as a logistic, this is the one! Notice that nice inflection point. The logistic, however, is not linearizable, as we see in the bear data example.

- Examples:

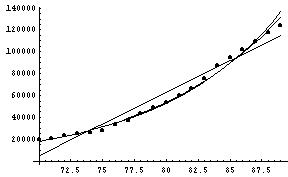

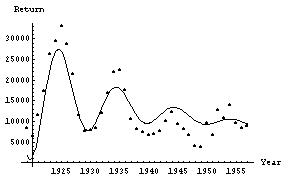

- Lynx data:

- Long term trend: horizontal asymptote (perhaps zero!)

- Decaying oscillations (some periodicity)

- Model: exponential decay to steady value (1,934 here), with decaying oscillations of ten-year period.

- Bear data - intrinsically non-linearizable model: the logistic

- Lynx data:

Notes:

- In the end, the result is to be a model. The question then becomes one of interpretability: can the model that results explain? Or is it simply a way of predicting values that are close to the actual, without any sort of knowledge being gained? We certainly hope that knowledge increases, based on the model that results.

- Mathematica file to generate these figures and models

Some Questions:

- What is the range for which the model might remain valid? How far can you trust this model (how far can you throw this model)?

- When is complexifying worthwhile? How do I decide whether R2 is okay?