- Your statistics quiz is returned.

- Key

- On the first part, Problem A, you should have explained

that the empirical rule applies to a normally distributed

random variable, and that it tell us the percent (fraction,

probability) of values that we expect to find. We expect to

find 68% of the values within one standard deviation of the

mean value.

So in the case of the investment, we expect to find 68% of the returns within $50 (one standard deviation) of the mean of $100.

We expect to find 95% of the returns within $100 of the mean (within two standard deviations -- that is, between $0 and $200).

And we expect to find almost all (99.7%) of the returns within three standard deviations (-$50 to $250).

From these values (and using the symmetry of the normal distribution) we can find other probabilities or percents. For example, since 50% of the returns come to the left of $100, and since 47.5% are greater than or equal to $0, we know that 2.5% of the returns will be negative -- that is, losses.

- In the second part, we talked in class about why you'd

expect to see some very late busses, but never any very early

ones. This makes the arrival times unbalanced, unsymmetric,

which automatically rejects a normal distribution.

And since we expect to see some surprisingly large values, we expect a fat-tailed distribution.

- Finally, on the second part of D, you were asked to find a

median value. As many of you noted, there are 30 arrival times

represented in this figure (add up the frequencies). So the

middle value corresponds to the mean of the 15th and 16th values.

Both of those value occur in the band labelled with 34.

Some of you found the median bin -- but we decide what bins to use. The median measures something fundamental about the data, not about our arbitrary choices....

- Key

- Our last topic begins this week: infinity. Be sure that you read

Chapter 30: The Hilbert Hotel. Infinity.

- This Friday, in lieu of a quiz, we're going to have Logo day. I

hope that you've started on your logo, and the one-page typed

description of your logo. It's due at class time, and you will each be

giving us a short description of your logo:

- How and why you chose your logo, and

- the mathematical content.

Google Drive's logo should look familiar -- I bumped into it last night:

what is it? and the critics, again....

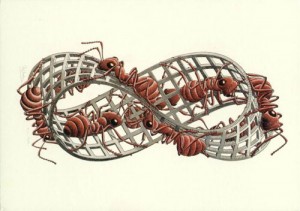

- What does this image have to do with our topic?

- Something similar, but not quite:

Eternity is tied up with the concept of infinity, frequently.

- What does this line from amazing grace's

sixth stanza have to do with this topic?

When we've been here ten thousand years...

bright shining as the sun,

we've no less days to sing God's praise

than when we've first begun.

About another Newton (other than Sir Isaac): John Newton 1725-1807; ironically Newton was a slave trader (who ultimately saw the error of his ways).

- Let's look at some curious problems about the Hilbert Hotel, the

subject of Chapter 30.

- The modern understanding of infinity dates to work done by

Georg Cantor, in the late 1800s.

- Our author quotes David Hilbert (himself a very famous and

brilliant mathematician), who said "No one shall expel us from the

Paradise that Cantor has Created."

Strogatz says that his objective is to "give you a glimpse of this paradise." (p. 253)

- Welcome to the Hilbert Hotel!

- there is a room for each natural number.

- Everyone can be asked to move (but only once per night).

- Notions of infinity rely on the idea of one-to-one correspondence, which you all no doubt recall from our early study of numbers.

- Can the Hilbert Hotel really be full?

- Hilbert Hotel and the infinite schoolbus

- Hilbert Hotel and the limitless stable of schoolbuses

- The modern understanding of infinity dates to work done by

Georg Cantor, in the late 1800s.

- Here's what we need to know:

- infinity is NAN: not a number

- infinity is NAS: not a size, either! the reason is that there

is more than one size of infinity! this is the most

important thing i want you to remember. (this fact will allow

you to win on the playground!;)

- The natural numbers are infinite in number (

).

- cardinality

- two sets have the same cardinality if there is a one-to-one correspondence between them.

- Here's a sensible rule you can be sure of: a subset is never

bigger in size than the set itself.

and if the sets are finite, the proper subset is always smaller....

but if the set is infinite, we may actually be able to throw away elements of a set and not change the size of the set!

- infinity is NAN: not a number

- Are the rational numbers a bigger infinity than the natural

numbers? (The natural numbers are a subset of the rational numbers.)

- The real numbers are bigger than the natural numbers, and we can

prove it -- by contradiction.

- We'll assume that they're not bigger -- that there is a one-to-one correspondence -- then show that that is impossible.

- We'll need this fact: every real number can be expressed by an infinite decimal.

- We need to be aware, however, that some real numbers are expressed by more than one decimal (for example, 1=.99999.... -- did you know that?)

- We'll show that just the real numbers between 0 and 1 are too numerous to be put in one-to-one correspondence with the natural numbers.

- We show this using a procedure that we might call "dodge ball".

- the power set: showers of infinities!

There are infinitely many sizes of infinity. It turns out that the power set of a set is always of larger cardinality than the set itself. Thus every infinite set is smaller than its power set, which is an infinite set, which is smaller than its power set, etc....